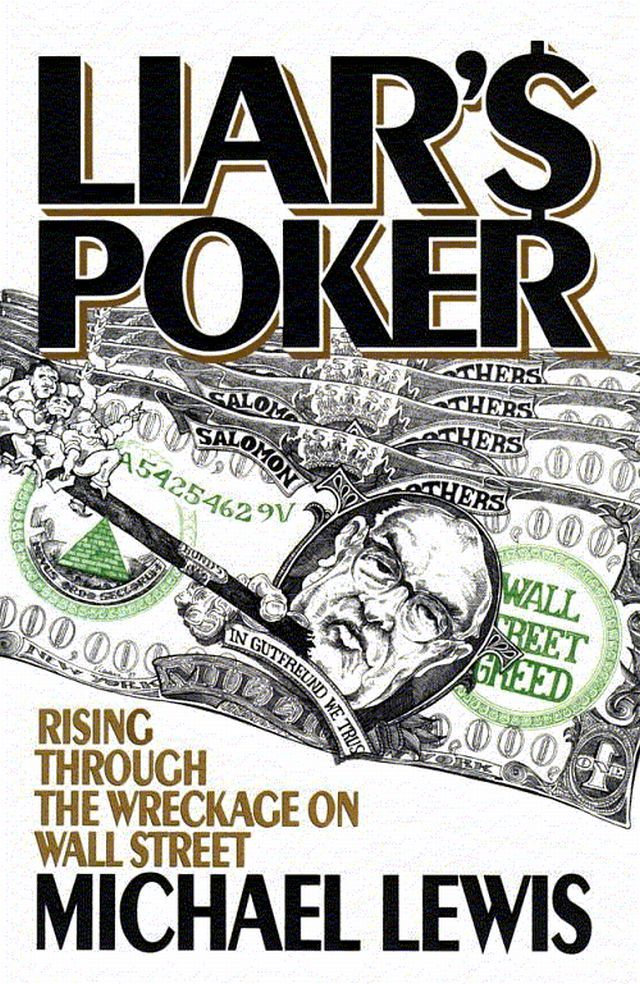

Michael Lewis’ book Liar’s Poker is a piece that gets mentioned pretty often in discussions about literary and participatory journalism. Written in 1989, the book is about Lewis’ experiences right out of college as a bond salesman on Wall Street during the 1980s. The book was supposed to be a cautionary tale about excess greed and the irresponsibility of the financial world; instead, it became a how-to manual for people interesting in getting into finance.

Michael Lewis’ book Liar’s Poker is a piece that gets mentioned pretty often in discussions about literary and participatory journalism. Written in 1989, the book is about Lewis’ experiences right out of college as a bond salesman on Wall Street during the 1980s. The book was supposed to be a cautionary tale about excess greed and the irresponsibility of the financial world; instead, it became a how-to manual for people interesting in getting into finance.

I’ve never read this book, but I was intrigued when I found a post at The Millions about how Michael Lewis is becoming a more prominent expert about the current financial crisis, since so much of what happened to the economy had its start during the 1980s. Lewis recently published a piece in Portfolio called “The End” that chronicles the current financial crisis and profiles some people who predicted some of these problems early on.

I don’t know nearly as much about the financial crisis as I should, although I suspect not many people do. That said, I think “The End” is an interesting article to read. A lot of the financial terminology was still over my head, but I think that’s probably because the article was written for a business magazine. Most of the article, especially the narrative about how much even the people working on Wall Street don’t seem to know what they are talking about, was compelling. If you’ve got a little time, check out the article.

UPDATE: Theresa at Shelf Love pointed me to an episode of This American Life from October that covers the economic crisis. I haven’t listened to it yet, but This American Life is always good stuff.

Have you read any interesting or understandable articles about the financial crisis?

Comments on this entry are closed.

No articles, but This American Life did a great show about the crisis back in October: http://www.thisamericanlife.org/Radio_Episode.aspx?sched=1263

I don’t know much at all about economics, but this show certainly helped me understand some aspects of the problem.

It’s scary once you realize your IRA, investment etc. is all a clever gamble. Most of time, it works out great, but sometimes, you just get screwed–and nobody can see it coming.

Actually, if you think about it, it’s very much like all the publishing companies entering bidding wars trying to find the next bestseller. You have an educated guess, a few guidelines, but it’s still a gamble, you don’t know until the book is on the shelves whether is actually going to sell or not.

Teresa: Thank you for that link! I remember this from before but never got to listen to it.

meg89: Yes, it is. Luckily I’m still a student, so I don’t have much invested anywhere. I like your analogy, although I think what’s happening on Wall Street is worse because in some ways people knew what they were betting on was no good but decided to do it anyway. That’s the scary part for me.

The thing about the financial crisis that strikes home to me is this: all the ‘money’ that was lost was ‘fake’ money. The only real money is what the peasants can hold in their hands. The rich have always inflated their bank accounts with fake money because they can afford to take the hit if it goes up in smoke. By convincing the peasant population – the average Joe – to live like the rich is the biggest crime of all. The market merely worked like it always has. But millions of average Joes cannot take the brunt of that dip in the market, and that is the sorrow of it all.

julia: Yeah, all of the money that isn’t really money seems crazy to me too. How is anyone supposed to really understand that?